LeafLink U.S. Cannabis Market Report – Spring 2024

Written by Ben Burstein

Despite some continued volatility in the industry today, the long-term prospects for U.S. cannabis remain stronger than ever. National sales reached all-time highs at the end of last year and continued to grow through March, cultivation capacity is in the process of rightsizing in mature markets, and license issuance is accelerating in key east coast states. Limited capital, oversupplied conditions, and generalized margin compression remain concerns for operators in the industry, but we see through LeafLink platform data and hear from customers that the market is in a much better place now than at any point over the past few years.

U.S. retail sales exiting March were likely the highest ever, reaching over $32 billion on an annualized run-rate per LeafLink internal estimates, up 21% year-over-year. U.S. wholesale sales are run-rating ~$11.2 billion, up 18% year-over-year. Pricing remains stable on the LeafLink platform, with aggregated platform flower prices hitting ~$1,120/lb through March, up ~10% year-over-year, but with some recent softness due to bulk flower harvested at the end of the summer hitting shelves in early Q4. Pricing has performed better than expected, largely driven by lower cultivation capacity in key legacy markets. The supply and demand balance is starting to rightsize in mature west coast states.

On the federal policy front, LeafLink expects an announcement from the DEA on rescheduling this year, with the most likely outcome being a recommendation to reschedule cannabis to Schedule III (eliminating the 280e tax burden for cannabis-touching businesses). At the state level, New York’s retail footprint is increasing after an injunction stalling the market’s rollout was finally lifted, Minnesota and Ohio are in the process of developing regulations for their recently-legalized adult-use markets, and Florida, Pennsylvania, and Virginia are weighing adult-use legalization this year. LeafLink sees strong greenshoots ahead supported by state and federal policymaking.

LeafLink Market Meter

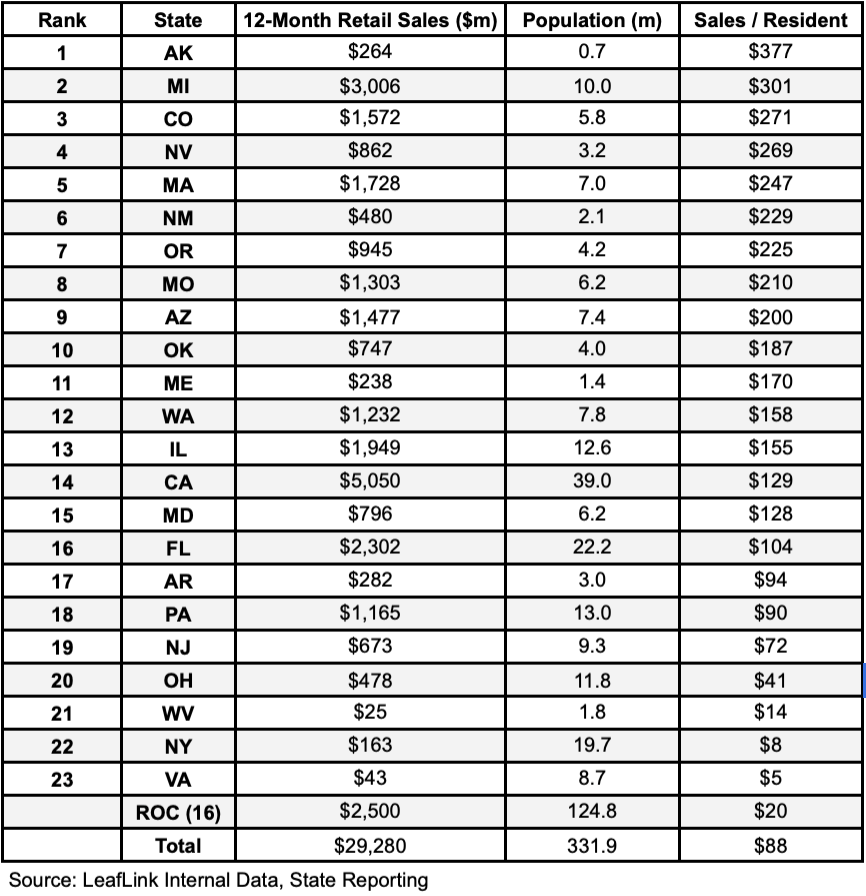

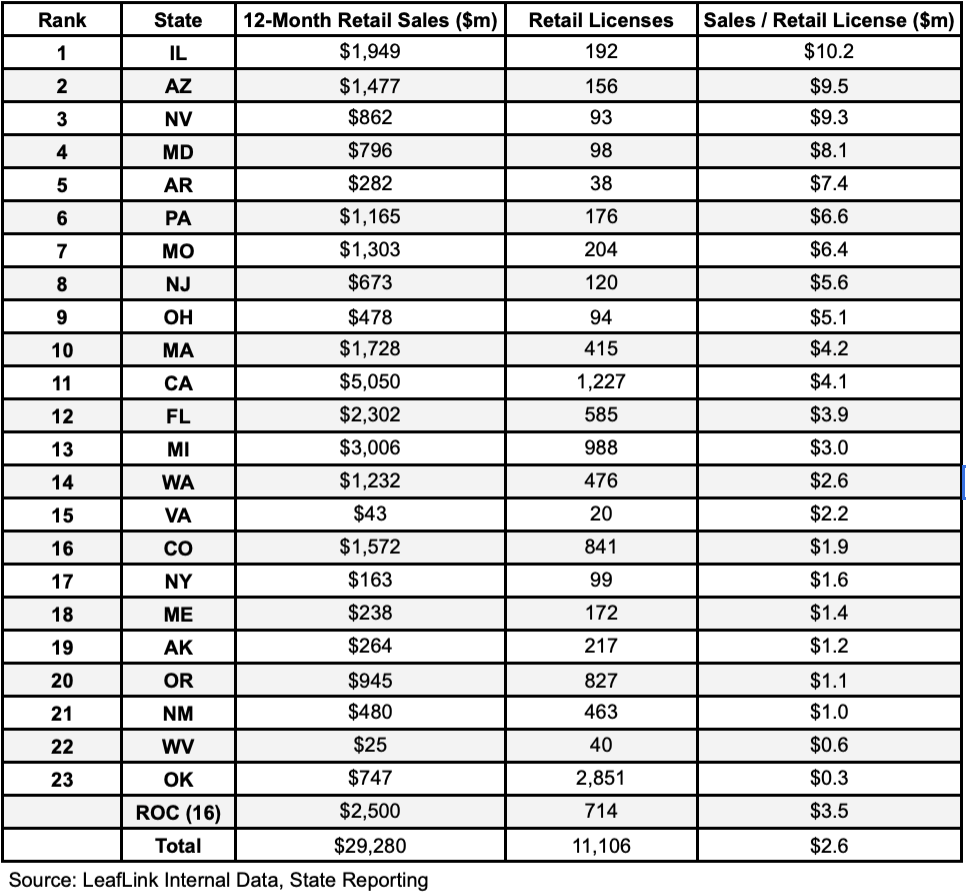

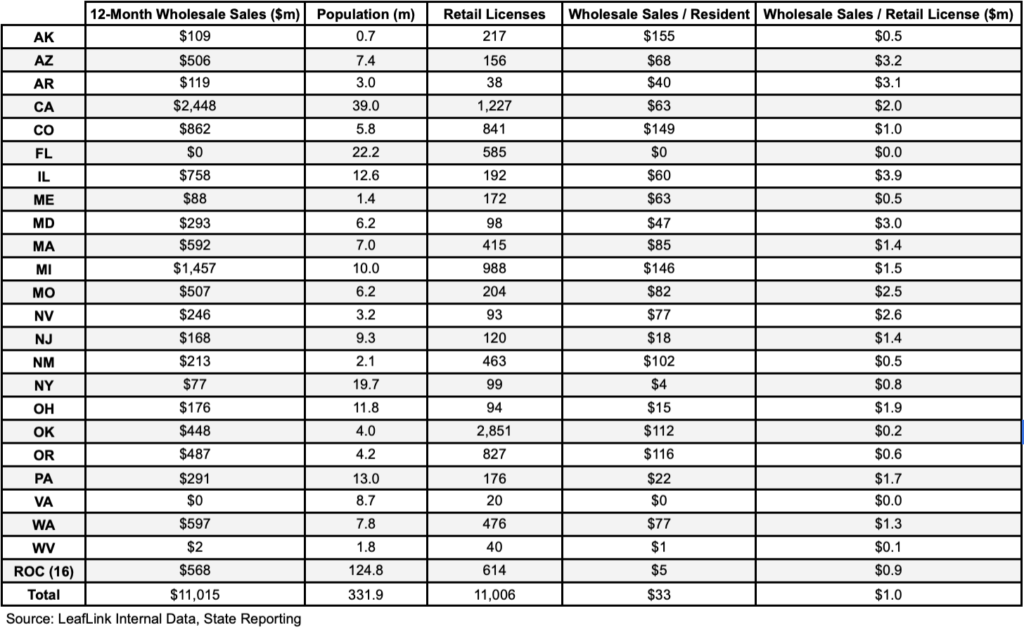

The LeafLink Market Meter provides a consistent measure of market activity in states with rankings of retail sales per resident, retail sales per dispensary, and data on wholesale market sales broken down along similar lines. This data helps compare key dynamics in markets across the country including consumer adoption, retail density, and average operator revenues and margins.

The rankings reveal that Alaska leads the nation in sales per resident driven by strong summer time tourism, with Michigan in hot pursuit. New York State’s nascent market clocks in at $8 per resident, second lowest only to Virginia’s narrow medical market.

Meanwhile, the limited number of open dispensaries in New Jersey is proving fruitful for operators, who lead the nation in per-store revenue while the more than 2,800 dispensaries in Oklahoma – the most in the nation – lags every other state measured.

The retail-level data presented applies the most recent data available as reported by state regulators and combined with LeafLink internal data to provide a reliable measurement. State retail sales are reported on a 30-60 day lag.

Retail Sales per Resident

Retail Sales per Dispensary

Wholesale Sales Metrics

Cannabis Wholesale Sales Data

U.S. wholesale sales were up 8.1% month-over-month in March to ~$960 million (~$11.5bn annualized wholesale run rate). As typical to prior years, March wholesale sales were elevated as retailers stock up on inventory for 420 and the April promo season.

Cannabis Retail Sales Data

U.S. retail cannabis sales were down 4.3% month-over-month in January to $2.52bn (~$30.3bn annualized retail run rate). Consistent with past years’ seasonality, January is typically the trough for winter-time sales between strong holiday period performance in December and the start of robust promotions in February / March. State retail sales are reported on a 30-60 day lag by state regulators. LeafLink will always publish the most recent available figures.

Cannabis Pricing Data

Pricing remains stable on the LeafLink platform, with aggregated platform flower prices hitting ~$1,120/lb through March, up ~10% year-over-year but with some recent softness due to bulk flower harvested at the end of the summer hitting shelves in early Q4. Pricing has performed better than expected, largely driven by lower cultivation capacity in key legacy markets. The supply and demand balance is starting to rightsize in mature west coast states.

Product Trend Tracker

Flower is the most popular form factor in cannabis, accounting for ~40% of retail sales and ~34% of wholesale sales. The next most popular form factors include cartridges (~25% of wholesale sales), pre-rolls (~13% of sales), edibles (~11% of sales), and concentrates (~11% of sales). Flower sales accelerated in March as dispensaries stocked up on inventory for 420 and related promos.

LeafLink Long-Term National Retail and Wholesale Sales Forecast

By 2030, LeafLink expects U.S. cannabis to be a ~$60 billion market, growing at a CAGR of ~11%. LeafLink expects most incremental sales in 2024 and 2025 to be driven by new license issuance in key states adding net new retail capacity (NY, NJ, MD, OH, IL, MN). Long-term, LeafLink expects growth to come from large population centers yet to legalize / approve robust market structures.

Report Methodology: Retail sales data is pulled from state-level sales reports; wholesale and internal LeafLink data pulled from 332k on-platform SKUs and over 1 million annual orders.